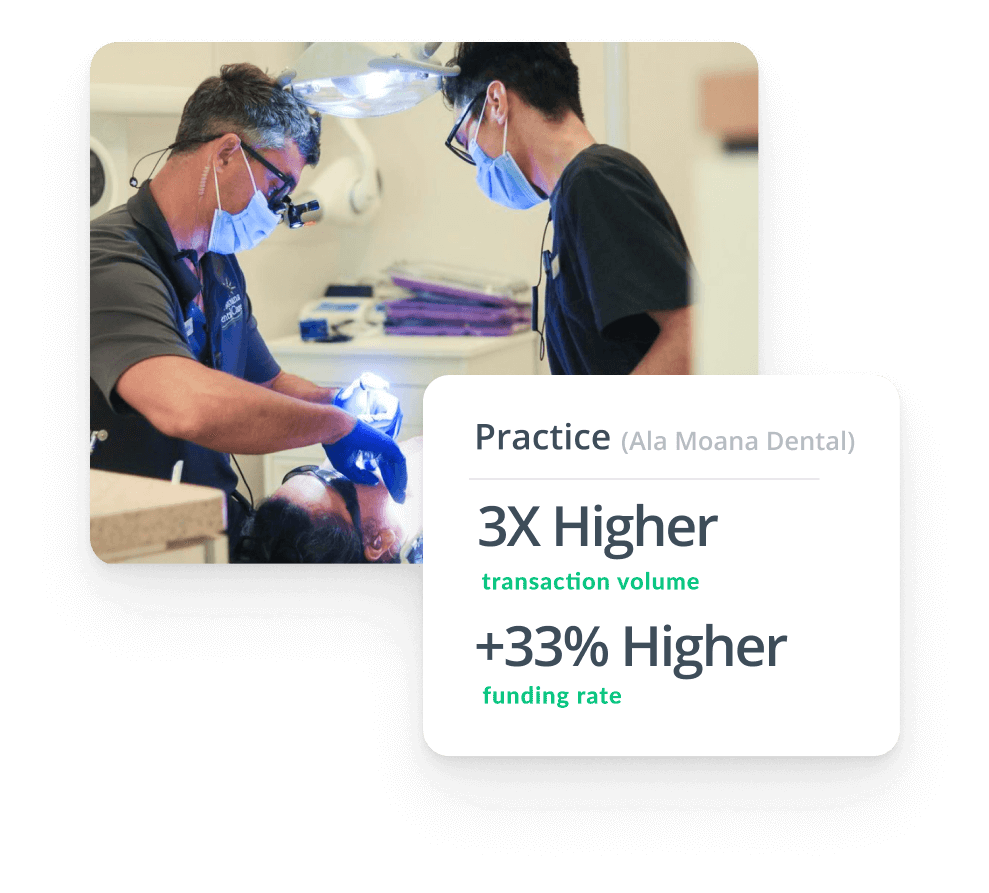

Trusted & Loved

by Industry-Leading Dental Practices

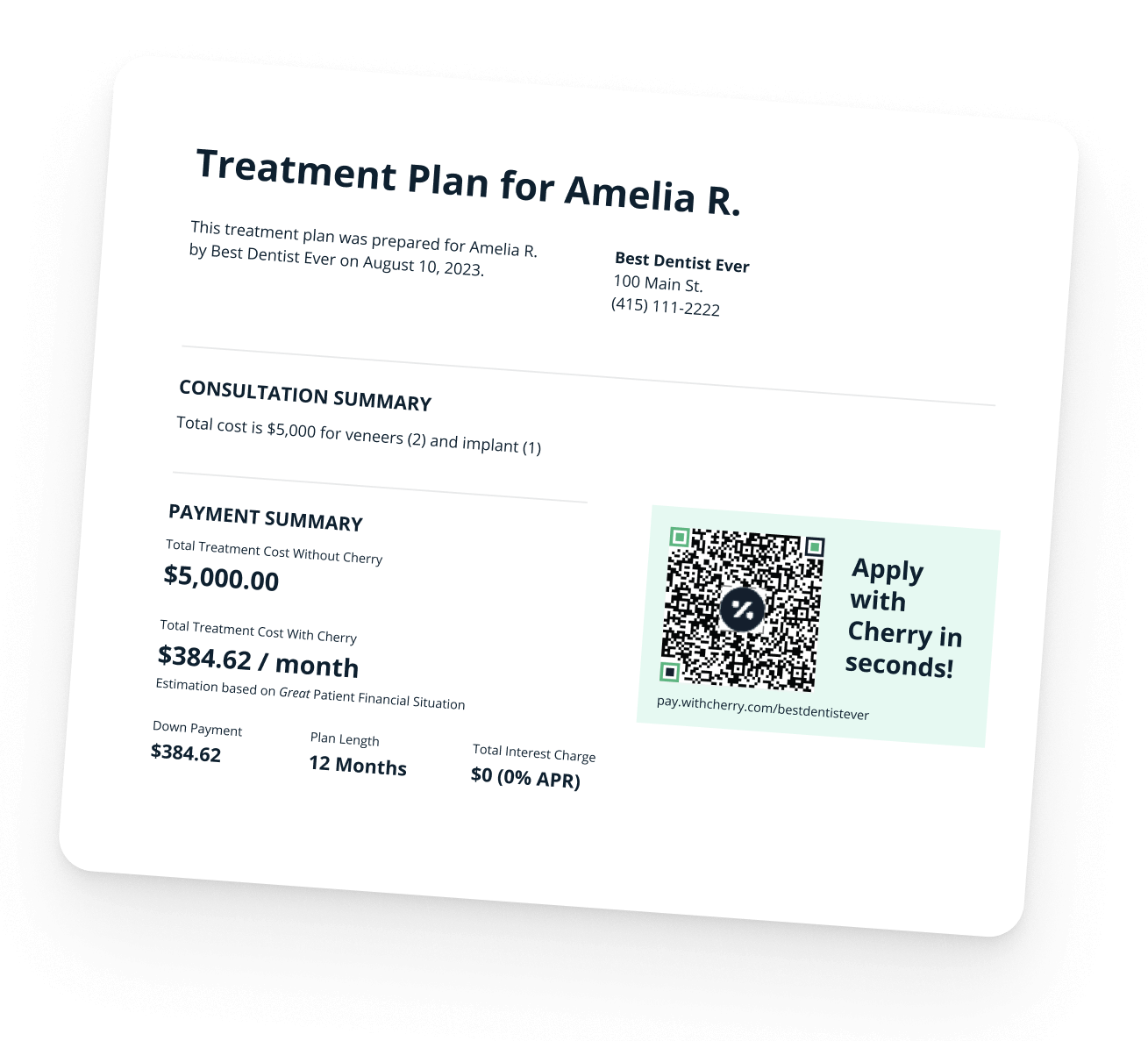

Treat more patients with Cherry Payment Plans for out-of-pocket expenses up to $35,000. Payment plans range from 3 - 60 months, with 0% APR options.

- Increase case acceptance by 30%

- Lower merchant fees by up to 50%

- Get paid 100% upfront

- More 0% APR options for patients & more patients approved for financing

Your information is always secure.

Your information is always secure.The (Almost) 5 Star Payment Plan Company

Cherry has a near perfect customer satisfaction score across our patients and practices.

I was worried the application would take long. I would have paid on my credit card - but it only took a few minutes and I'm so happy I can split my payments up now!

They are helping our patients get the financial help they need and help overall our office growth.

No fuss. Instant approval. Choice of payment. In fact if possible I'd like to see if I qualify for another procedure with Dr. Luca @withCherryUS.

@withCherryUS is very easy for the patient to apply for, and the approval rating is better than any other company we have used in the past.

Quick and hassle-free process, and was able to meet my financial needs!

We love @withCherryUS! Our patients love Cherry too. We love that the patient controls the application process and has visibility to every step of the process.

More Patients,

More Treatments

in case acceptance

in transaction size

to your practice

Monthly Pricing

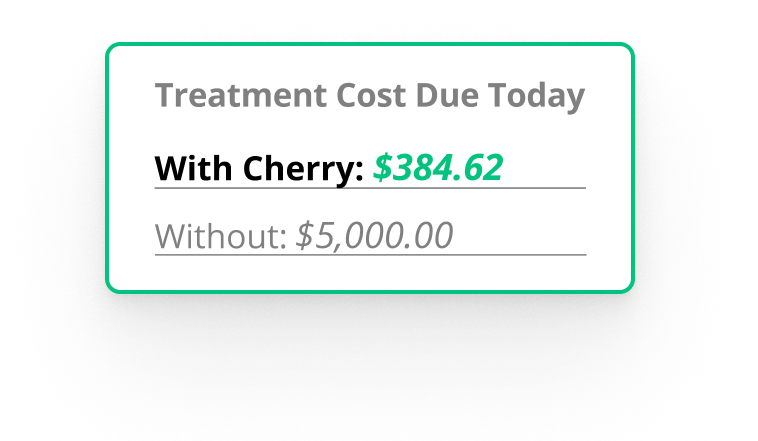

Looks Better

- Enable your patients to turn large expenses into smaller, monthly payments

- Monthly pricing is easier to talk about

Save on Time & Money

Lower your

your

merchant fees

Save up to 50% on your merchant fees.

Get paid

upfront

Receive full payment in 2-3 business days.

Easily improve your cash flow.

Reduce billing

billing

headaches

Cherry handles repayment directly with your patient. Leave the billing and coordination work to us, so that you can focus on treating your patient.

BOOK YOUR FREE DEMO

Speed Through Checkout

Apply in 60 Seconds or less

- Fast patient application

- No hard credit check

- Instant funding

- True 0% APR options

- Simple, transparent pricing

Best-In-Class

Support

- Free marketing resources for social media, email & video

- Fast US-based phone, email & chat support

*References here

now

now