What is POS lending and why is it so popular?

Consumers are now looking for more creative ways to stretch their dollar more than ever, that is why we are seeing a rise in point of sale lending or POS lending. So what is POS lending? POS lending is when a merchant offers their clients a pay over time solution at the point of purchase. Traditionally, POS lending have been around to help customers pay for bigger ticket items such as furniture, home renovation projects, or cars, however due to technological advancements it is now easier for merchants in all sectors to offer POS financing.

There is also an upward trend in adoption amongst younger consumers. Millennials nowadays are turning away from credit cards and favoring the transparency of set payment plans. In a recent studies have found that “3 in 5 millennials carry credit card balances month to month, while 45% don’t know the interest rate on their card”. Merchants on the other hand are seeing a boost in sales, conversion rates, and cash flow from offering POS lending solutions.

Shift in Customer Purchase Journey

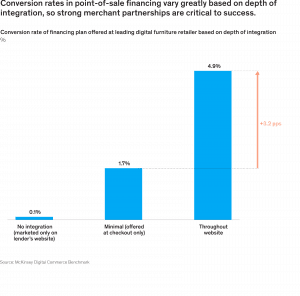

The average consumer today is the more informed and savvier than ever before. Studies show that “around 75 percent of consumers who finance large-ticket purchases decide to do so early in the purchase journey, before the actual purchase. Merchants who integrate POS lending as part of their offerings early on are seeing fast success. Show casing that you can offer payment plans from “research to checkout, increases the conversion rate by two to three times, relative to a simple integration at checkout”.

Sources:

Sources:

https://www.cbinsights.com/research/pos-lending-payments-trends/