What is Medical Financing?

Medical costs have been on a steady rise in the last decade. According to one survey, 79 million Americans can’t pay their medical bills or debt. You might be wondering about the insurance companies and what types of medical expenses they cover. Even though many Americans have health insurance, sometimes the patients themselves have to pitch in for the bill.

This is where medical financing comes into play. Payment plans can help with emergency procedures or anything your insurance company doesn’t cover. Placing your health and well-being first should always be a priority, so here is everything you need to know about medical financing!

What is a healthcare payment plan?

Medical bills can be pretty high, and paying them in a single installment feels like a dream for most of us. However, patients can now choose a payment plan to pay those bills in monthly installments.

If you have ever taken out a student loan, you are probably familiar with how payment plans work. Instead of paying the entire sum upfront, you can break it down into smaller and more manageable parts.

Payment plan vs. credit card for medical expenses

Medical expenses are often unplanned, and many patients will consider paying them with a credit card. A payment plan is a better option because a credit card’s high interest and fees will increase the overall medical bill. You will end up spending way more money than initially planned. Covering the whole amount with a credit card could damage your credit score too.

Using your card for a medical emergency might look like the easiest way to pay your healthcare provider, but it really isn’t. Look into personal and medical loans. The latter could also be interest-free or with a lower interest rate, depending on the financing provider. Remember that you always have a choice!

What is a medical credit card?

Medical credit cards are being advertised lately, and they could come in handy in some situations. As the name suggests, this is a classic credit card used for financing medical treatments. Hospitals and healthcare providers might recommend them to you, depending on what your insurance covers.

Unfortunately, medical credit cards might not be the best solution, especially if you don’t have a way of paying off the debt within the promotional period with zero interest. Ultimately, a medical credit card is not much different than a standard credit card.

Benefits of using a payment plan

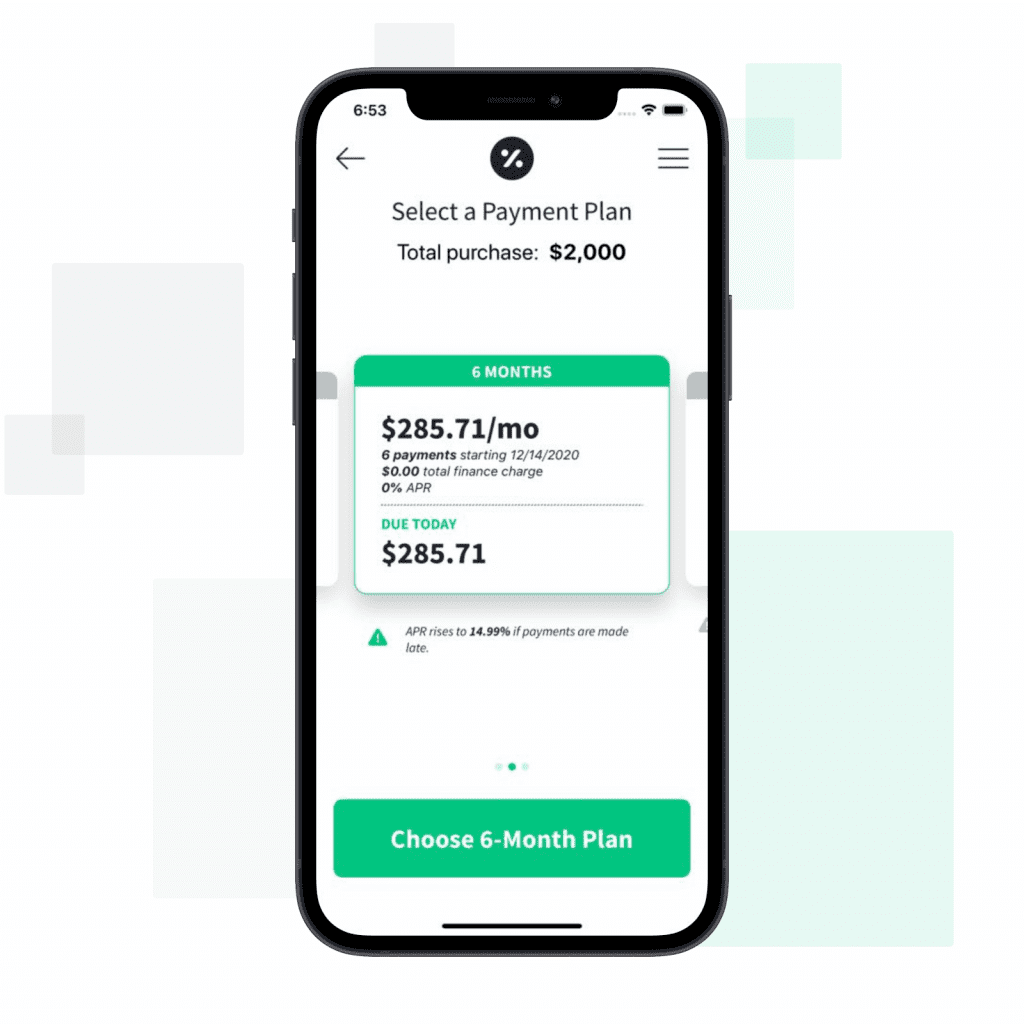

Payment plans are excellent because they allow a patient to pay the bill in monthly payments and avoid falling into a financial hole. Once you set up a payment plan, you can “set it and forget it” by turning on auto-pay.

Medical practices offer different plans, so ask for full disclosure before signing the agreement. In fact, there are payment plans that cover treatments and services outside of the hospitals and doctor’s offices that we normally think of for medical procedures. For example, Cherry is a popular provider of patient financing offered by med spas. That’s right, you can use Cherry’s payment plan for laser hair removal, botox, fillers, coolsculpting, and many other treatments not covered by traditional health insurance.

What is prequalification for healthcare financing

Potential borrowers can check the loan amount they are eligible for by prequalifying. The borrower typically submits a short online application to the lender, the lender conducts a credit check and then provides loan options with different terms.

Make sure that the lender does a soft credit check, as a hard credit check will hurt your credit score. Cherry, for example, only does soft credit checks and provides quotes as soon as you submit your application. This means you can find out your loan options on the spot with Cherry. (Note that not all lenders are as quick and consumer friendly as Cherry, so be sure to do your research before applying.)

Benefits of being prequalified for a loan from a lender

Once you complete the prequalification check and everything is okay, you are NOT obliged to accept the medical loan from a lender. If the loan terms, loan rates, and loan offers are not working for you, there are plenty of medical loan providers out there, so keep looking! Just make sure any lender you apply with does a soft credit pull to avoid having your credit score penalized each time.

What happens once I accept a medical loan?

When you accept a loan, you will commonly experience a hard credit inquiry. (Note that this is different from being prequalified, as described above, where you can see your loan options but are not obligated to accept them.) For medical financing, your interest rate will typically be fixed over a period of time. Borrowers with good credit scores may qualify for 0% APR options, depending on the financing provider. The other great thing is that this is an unsecured loan, meaning you will not need to put up collateral.

Be sure to understand the repayment terms. While some financers like Cherry are simple and transparent, others may charge a fee if you pay your loan off early, have compounding interest, retroactive APR, or other hidden fees.

Financing option for healthcare: A personal or a medical loan?

A medical loan is essentially a personal loan, but restricted to medical procedures and usually have better terms. If you have a great credit score, you may even qualify for 0% APR options like with Cherry. You can also choose the loan duration that fits your budget; for example, Cherry offers 3, 6, 12, 18 and 24 month payment plans. In general, if you know that you only need financing for medical treatments, then you’re better off getting a medical loan instead of a personal loan.