More Patients,

More Treatments

in case acceptance

in transaction size

patient approval rate

to your practice

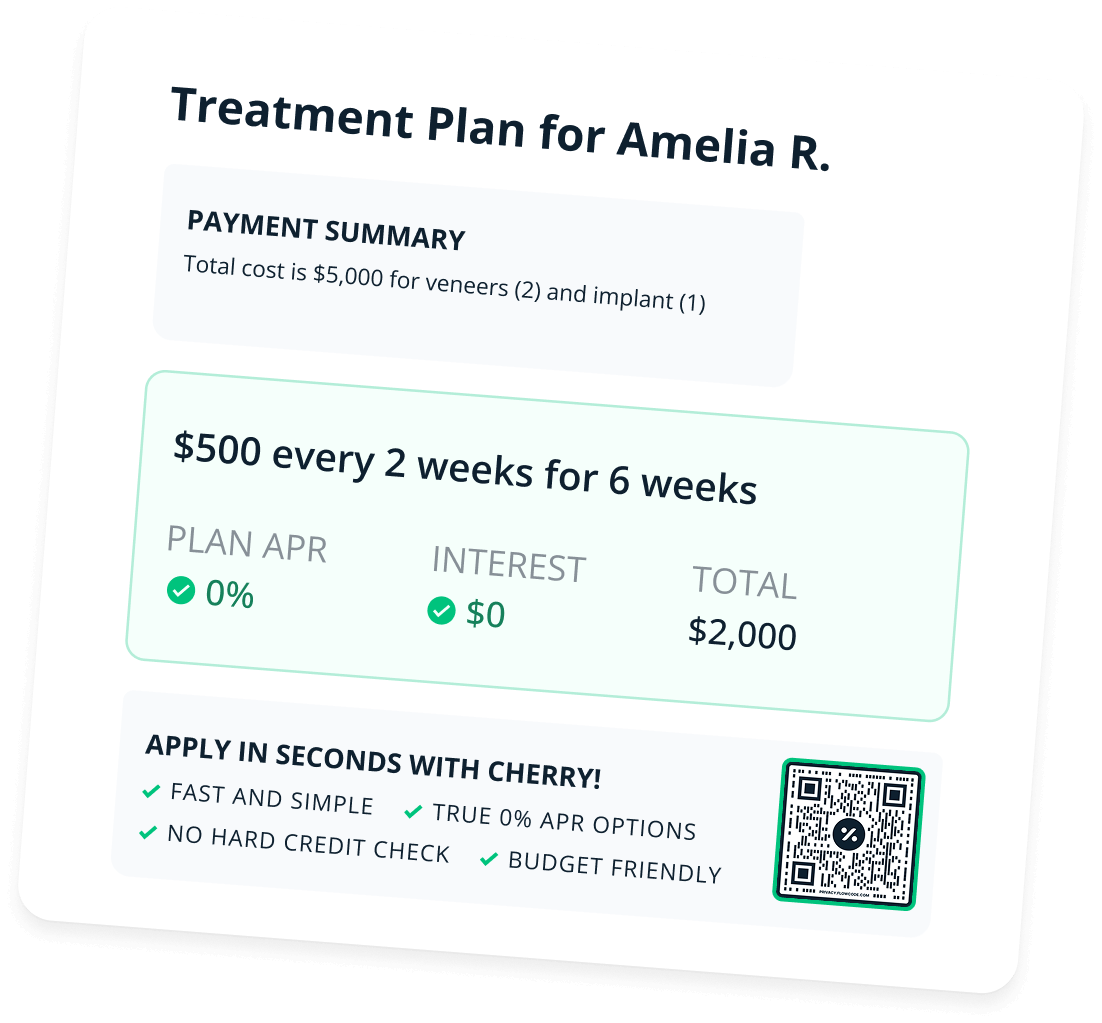

Treat more patients with Cherry Payment Plans for out-of-pocket expenses up to $50,000.

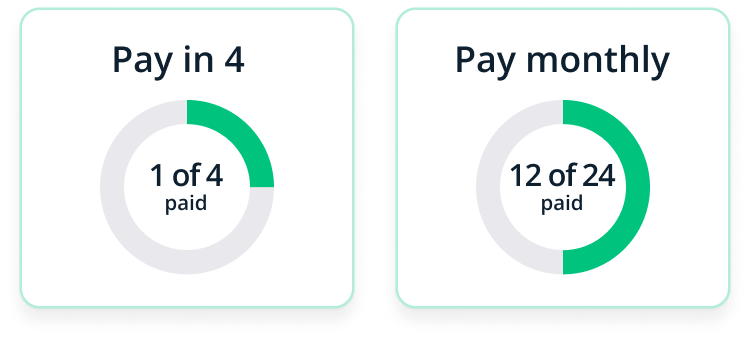

Payment plans range from 6 weeks of always interest-free to 60 months with qualifying 0% APR or as low as 5.99%.

Cherry has a near perfect customer satisfaction score across our patients and practices.

Cambridge Family Dental

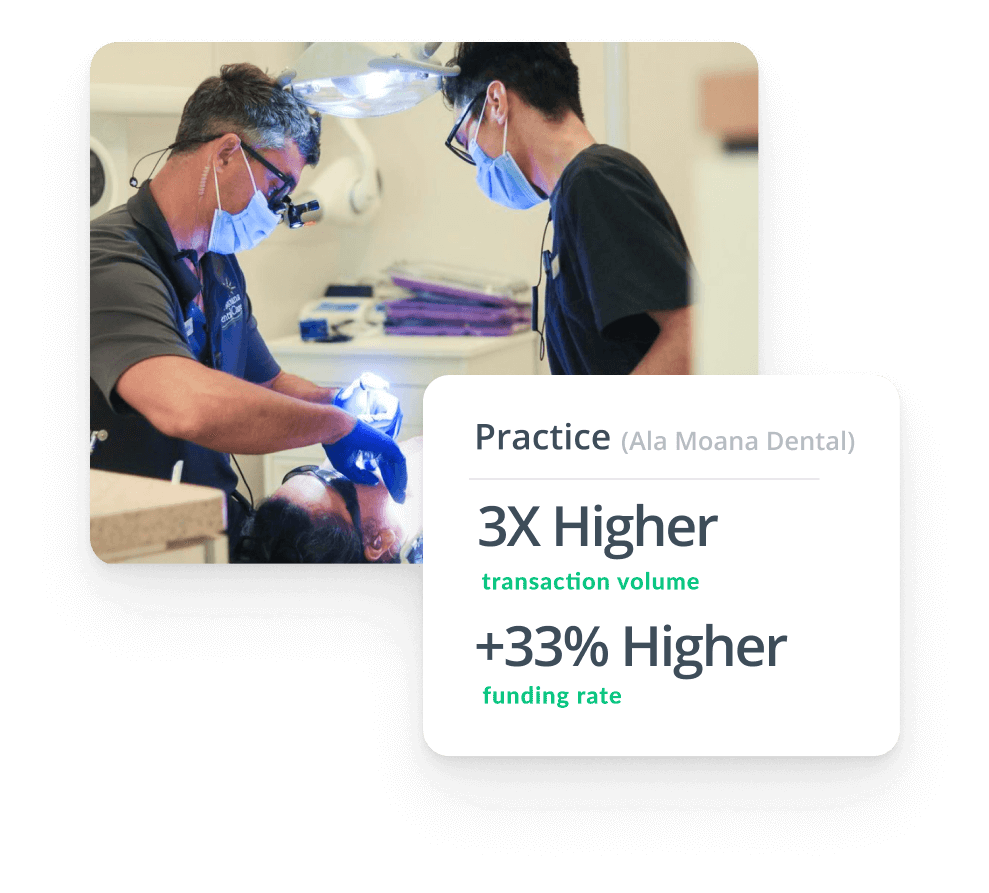

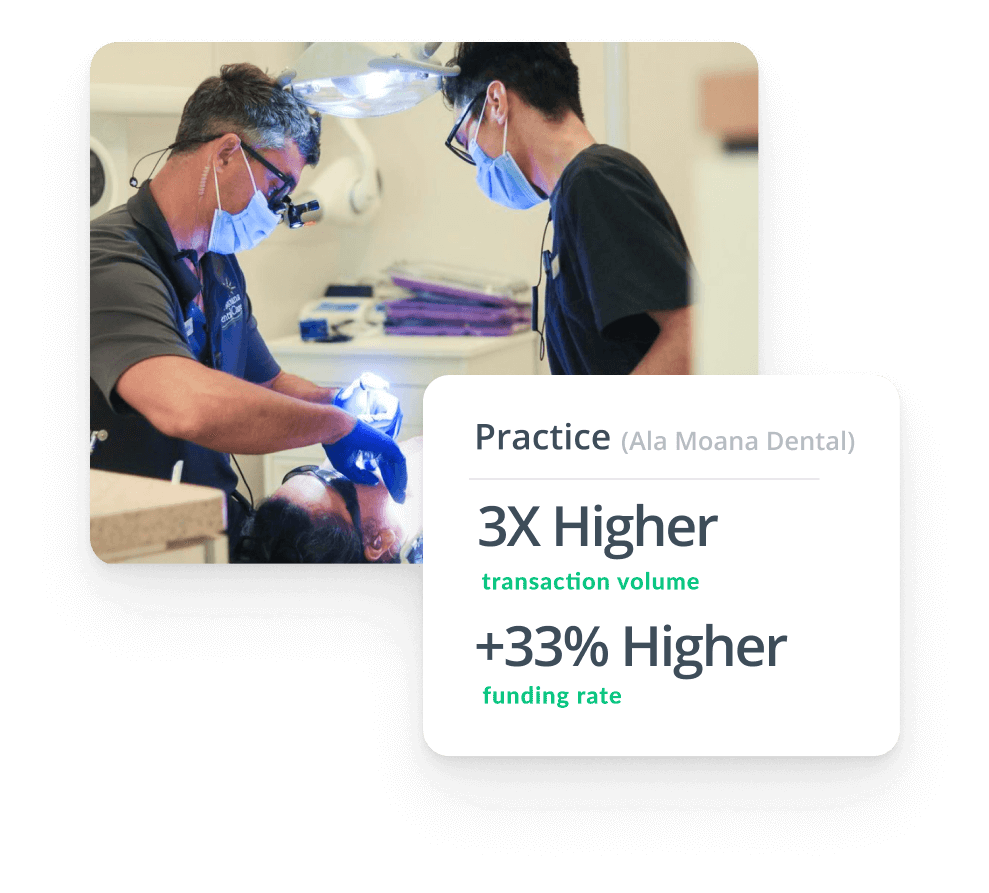

Practice

@withCherryUS is very easy for the patient to apply for, and the approval rating is better than any other company we have used in the past.

Kristan L.

Patient

Quick and hassle-free process, and was able to meet my financial needs!

Charlotte Dental Pro

Practice

We love @withCherryUS! Our patients love Cherry too. We love that the patient controls the application process and has visibility to every step of the process.

Bryan W.

Patient

I was worried the application would take long. I would have paid on my credit card - but it only took a few minutes and I'm so happy I can split my payments up now!

Abraham DDS Dental Corp

Practice

They are helping our patients get the financial help they need and help overall our office growth.

Carol T.

Patient

No fuss. Instant approval. Choice of payment. In fact if possible I'd like to see if I qualify for another procedure with Dr. Luca @withCherryUS.

Cambridge Family Dental

Practice

@withCherryUS is very easy for the patient to apply for, and the approval rating is better than any other company we have used in the past.

Kristan L.

Patient

Quick and hassle-free process, and was able to meet my financial needs!

Charlotte Dental Pro

Practice

We love @withCherryUS! Our patients love Cherry too. We love that the patient controls the application process and has visibility to every step of the process.

Bryan W.

Patient

I was worried the application would take long. I would have paid on my credit card - but it only took a few minutes and I'm so happy I can split my payments up now!

Abraham DDS Dental Corp

Practice

They are helping our patients get the financial help they need and help overall our office growth.

Carol T.

Patient

No fuss. Instant approval. Choice of payment. In fact if possible I'd like to see if I qualify for another procedure with Dr. Luca @withCherryUS.

Cambridge Family Dental

Practice

@withCherryUS is very easy for the patient to apply for, and the approval rating is better than any other company we have used in the past.

Kristan L.

Patient

Quick and hassle-free process, and was able to meet my financial needs!

Charlotte Dental Pro

Practice

We love @withCherryUS! Our patients love Cherry too. We love that the patient controls the application process and has visibility to every step of the process.

Bryan W.

Patient

I was worried the application would take long. I would have paid on my credit card - but it only took a few minutes and I'm so happy I can split my payments up now!

Abraham DDS Dental Corp

Practice

They are helping our patients get the financial help they need and help overall our office growth.

Carol T.

Patient

No fuss. Instant approval. Choice of payment. In fact if possible I'd like to see if I qualify for another procedure with Dr. Luca @withCherryUS.

What a great company. I was approved for a loan with no interest! A gift for sure with today’s interest rates. I’ve used Cherry twice and have found the process to be seamless, simple and quick!

We love @withCherryUS! Our patients love Cherry too. We love that the patient controls the application process and has visibility to every step of the process.

Cherry allowed me to get dental work done that I otherwise was unable to receive. I'm happy the dental office was able to help me sign up. It was quick and easy and completed in the office.

Cherry has made it extremely easy for us and our patients to apply. We have had a great turn around for treatment acceptance from our patients who have been approved for Cherry's financing.

Save as much as 50% on your merchant processing fees.

Receive full payment in 2-3 business days. Easily improve your cash flow.

Cherry handles repayment directly with your patient, so you can focus on providing care.

Cherry is a third-party financing provider that helps consumers access essential services — like veterinary, dental, and medical care — by breaking payments into monthly or weekly installments.

Used by a wide range of businesses, Cherry supports providers through flexible financing options that match their customers’ healthcare needs. For a dental practice, Cherry disburses funds to clients seeking to address dental needs like teeth cleaning, a root canal, or cosmetic procedures. The provider gets paid the full amount upfront for their services, and the client repays Cherry over time.

Here’s how it works:

We offer loan amounts up to $50,000, flexible repayment terms between 1 and 60 months, and competitive interest rates — including interest-free plans for Pay in 4 and qualifying 0% annual percentage rate (APR) for longer monthly plans.

Our financing program can typically be integrated into dental offices the same day, enabling immediate improvement on case acceptance rates, cash flow, and patient enrollment.

Patients can apply for financing in less than 60 seconds, with no hard credit check, and see qualifying loan options instantly. Typically, they’ll receive same-day approval, but it may take up to 48 hours.

Unlike many third-party financing options, we boast an industry-leading 80%+ approval rate, accommodating a wide range of borrowers across credit profiles. For Pay-in-4 (our 6-week plan), we approve ~90% of applicants.

Payments to dental providers are processed upfront when the transaction is made, and depending on the provider’s bank, funds should arrive electronically in no later than 3 business days.

No, we handle repayment directly with borrowers so you can focus on providing dental services to your patients. There’s no risk to your practice or in-house management for you or your team. It’s just one of the reasons over 50,000 medical practices rely on Cherry.

Yes. When patients are approved, they’ll make a down payment using a traditional credit card like Visa or Mastercard, or a non-prepaid debit card.

Credit cards incur a small 2.99% processing fee, while standard debit cards (linked to a bank account) have no fee. Please note that prepaid cards, including Cash App cards and gift cards, aren’t accepted. To confirm whether your card is prepaid, look for the word “prepaid” on the card or contact your card issuer.

There’s no annual fee to access Cherry’s flexible payment plans. Merchant fees apply, but they’re up to 50% lower than other financing companies.

Offering flexible payment options helps patients manage out-of-pocket dental costs and promotes wellness through regular checkups and adherence to treatment plans. With more ways to pay, you make it easier for patients to move forward with dental treatment.

As a practice, freeing yourself from the burden and risk of in-house financing, improving cash flow, and expanding treatment acceptance can have transformative effects — which is why some Cherry providers, from small businesses to multi-location clinics, have seen a big boost in business since adopting our third-party financing solution.

We perform a soft credit check to prequalify patients — never a hard credit check. No credit check performed by Cherry will hurt the applicant’s credit score.

Yes. Patients can complete a 60-second loan application and receive an instant approval decision before committing to dental treatment. While this is sometimes referred to as “pre-approval,” Cherry provides a real approval decision upfront — without requiring patients to move forward with care.

Knowing their approval status in advance allows patients to review available financing options, understand potential payment terms, and decide next steps at their own pace. This helps reduce uncertainty and makes it easier to plan treatment or schedule an appointment today when they’re ready.

Yes, patients can manage their plan online and track monthly payments from an easy-to-use dashboard.

Cherry Payment Plans can be used for a wide range of dental treatments, from preventive care to dental emergencies. Patients often use Cherry to help manage treatment costs associated with preventive visits, restorative care, and advanced dental work such as oral surgeries, treatment for missing teeth, or full-mouth rehabilitation plans. Other dental work commonly financed through Cherry:

Because dental costs can add up quickly, financing gives patients flexibility when pursuing quality dental care that supports long-term oral health. By spreading payments over time, patients are better able to move forward with recommended care and work toward a healthy smile without delaying treatment due to cost concerns.

Unlike personal loans, our third-party financing provides immediate loan offers tailored to oral health treatment for borrowers in a wider range of financial situations, and we never use a hard credit check during the credit approval process. Traditional personal loan lenders typically reserve their lowest rates for borrowers with excellent credit, while Cherry works to approve more patients and offer fair, transparent terms and competitive fixed rates regardless of credit history. What’s more, dental patient financing through Cherry can only be used for treatment offered by the Cherry provider, and not for any other purchase from any other provider.

Patients with both good credit and bad credit can qualify for financing plans tailored to their individual circumstances. At Cherry, we know that credit history is only a glimpse of a patient’s financial situation, and with a proprietary underwriting algorithm, we’re able to look beyond outdated markers of financial stability to accept a wider range of borrowers who may not meet traditional credit approval standards.

Yes, even if your patients have insurance coverage, they can still use Cherry to cover dental expenses, or portions of out-of-pocket expenses, not fully covered by healthcare providers.

Even with insurance, their dental benefits may not fully cover the cost of care. Many patients still face significant out-of-pocket costs. Insurance plans often include deductibles, copays, annual maximums, or waiting periods that limit how much coverage is available when care is needed. Patients may also encounter restrictions based on whether a provider is in-network or how their insurance company classifies certain procedures.

As a result, financing can help bridge the gap between dental coverage and the actual dental care costs patients are responsible for. Cherry helps reduce financial stress by allowing patients to spread payments over time, making treatment more manageable and helping practices support both existing patients and new patients who might otherwise delay care due to cost concerns.

Patients use lots of different ways to pay for dental treatment, and Cherry is designed to work alongside — or as an alternative to — those options. Some patients rely on HSAs (health savings accounts) or FSAs (flexible spending accounts) to cover dental expenses, but these accounts may have limited balances or timing restrictions that don’t always align with higher upfront costs.

Others consider credit cards, personal loans, or financing through credit unions, which can sometimes involve higher interest or less predictable repayment terms. Compared to those options, Cherry offers fixed payment plans with lower rates (true 0% financing for qualified borrowers) than many traditional financing alternatives, helping patients better manage overall medical expenses.

Patients may also look into reduced-cost care through dental schools, which can involve longer timelines or limited appointment availability. Cherry provides another path to affordability, allowing patients to move forward with care now and buy now, pay later through structured, transparent payment plans and low interest rates for qualified borrowers.

No, Cherry dental loans do not include origination fees, prepayment penalties, or any hidden fees that might be charged by traditional lenders, ensuring transparent and fair financing for dental patients.

No, Cherry does not offer a medical credit card or any type of revolving line of credit for healthcare financing.

Cherry does not use deferred interest in any special financing options. Qualified borrowers are eligible for true 0% APR.

CareCredit.com, on the other hand, offers 0% promotional financing that relies on deferred interest. If the full balance isn’t paid off by the end of the promotional period, or if one payment is missed during that period, interest is charged to cardholders retroactively from the purchase date at a steep APR.

At Cherry, we’re different from the CareCredit Credit Card because we don’t offer a high-interest credit card or perform a hard credit check on your patients; our plans don’t apply deferred interest; we boast nearly double the approval rate; we offer a simple 60-second application with instant approval decisions; and our merchant pricing is up to 50% cheaper for dental practices.

Cherry is different from Sunbit because we don’t specifically focus on borrowers with bad credit (instead, we offer wide eligibility and high acceptance rates for users of varying creditworthiness), and our patient financing focuses specifically on healthcare providers and patients. Sunbit, on the other hand, has no specialization, offering solutions for the automotive industry, healthcare, and other everyday needs.